Since 2014 Harley-Davidson‘s (NYSE: HOG) shipments have fallen from 270.7K in 2014 to 228.7K in 2018 which represents a total fall of 15.5%. The primary reasons are a shrinking market for their heavy weight bikes and a global slowdown.

Please refer to the Trefis interactive dashboard – Why Are Harley-Davidson’s Shipments Falling? – to understand the annual change in Harley-Davidson’s shipments.

- Harley-Davidson’s Total Worldwide Shipments have been falling continuously since 2014.

- Annual Shipments have fallen from 270.7K in 2014 to 228.7K in 2018 which represents a total fall of 15.5%.

- Trefis estimates a further 8% reduction and Total shipments to be around 210.4K in 2019.

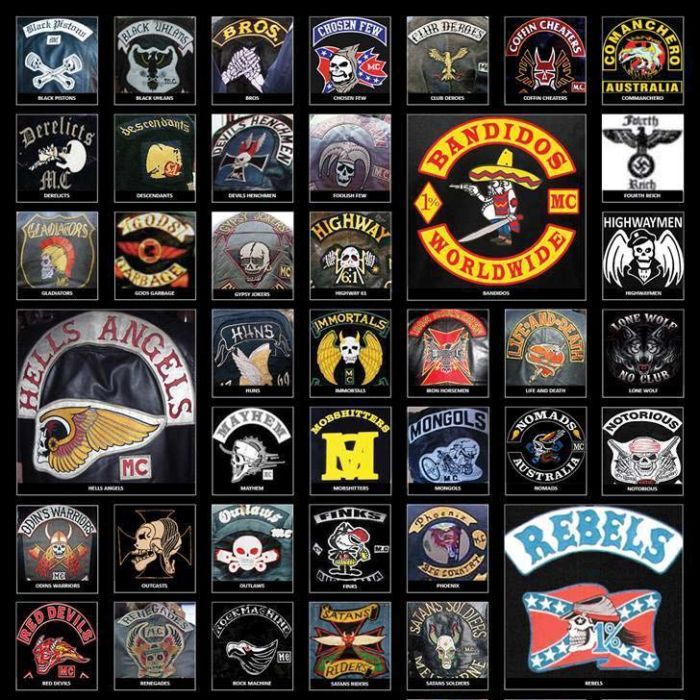

Check out James “Hollywood” Personal Editorials on what’s happening in the Biker Scene.

US Shipments:

- Harley-Davidson’s US Shipments have been falling continuously since 2014.

- Annual Shipments have fallen from 174K in 2014 to 132.4K in 2018 which represents a total fall of 23.9%.

- Trefis estimates a further 9% reduction and US shipments to be around 120.5K in 2019.

International Shipments:

- International shipments have fluctuated but in 2018 were quite similar to the 2014 numbers and thus flattish over the period.

- Trefis estimates a 6.6% reduction in 2019 and International shipments to be around 89.9K.

Why?

- U.S. Heavyweight Motorcycle shipments account for almost 60% of the company’s overall motorcycle sales (in 2018), making it the largest single geographic market for Harley-Davidson. Over the past few years, overall heavyweight motorcycle sales have declined significantly in the U.S. The fall is attributed to a shrinking market in the country and an overall global auto slowdown.

- International shipments have been flattish over the period. In 2019 the fall is expected primarily due the global market slowdown.

So What?

- A continuously falling sales volume doesn’t bode well for Harley-Davidson. The company announced steps to curb the fall by introducing a “More roads to Harley-Davidson” plan in 2019. The plan’s strategic objectives through 2027 are to: build 2 million new riders in the U.S., grow international business to 50% of annual volume, launch 100 new high impact motorcycles, and do so profitably and sustainably.

- The company is also working on exploiting the EV market to increase its market penetration. In November, 2018, the company’s first electric Harley-Davidson was debuted at the Milan Motorcycle Show.

- The positive here is that the company has acknowledged its difficult times and has set up plans to combat this.

One response to “Harley-Davidson sales have plunged since 2014 Harley-Davidson no longer king and faces steep obstacles in maintaining dominance in industry”

The market is flooded for all motorcycle manufacturers.

LikeLike